The Definitive Guide for Estate Planning Attorney

Table of ContentsWhat Does Estate Planning Attorney Do?Not known Incorrect Statements About Estate Planning Attorney Not known Incorrect Statements About Estate Planning Attorney The smart Trick of Estate Planning Attorney That Nobody is Discussing

Your lawyer will certainly also assist you make your records authorities, scheduling witnesses and notary public signatures as required, so you do not need to worry concerning attempting to do that final action on your very own - Estate Planning Attorney. Last, however not least, there is beneficial comfort in developing a partnership with an estate preparation lawyer that can be there for you later onBasically, estate planning lawyers offer value in many methods, far beyond just providing you with printed wills, counts on, or other estate preparing documents. If you have questions about the procedure and want to discover more, call our workplace today.

An estate planning lawyer assists you formalize end-of-life choices and legal files. They can establish up wills, establish trust funds, produce health care regulations, establish power of attorney, create sequence strategies, and much more, according to your wishes. Dealing with an estate planning attorney to complete and supervise this legal documentation can aid you in the following 8 areas: Estate intending attorneys are experts in your state's trust fund, probate, and tax laws.

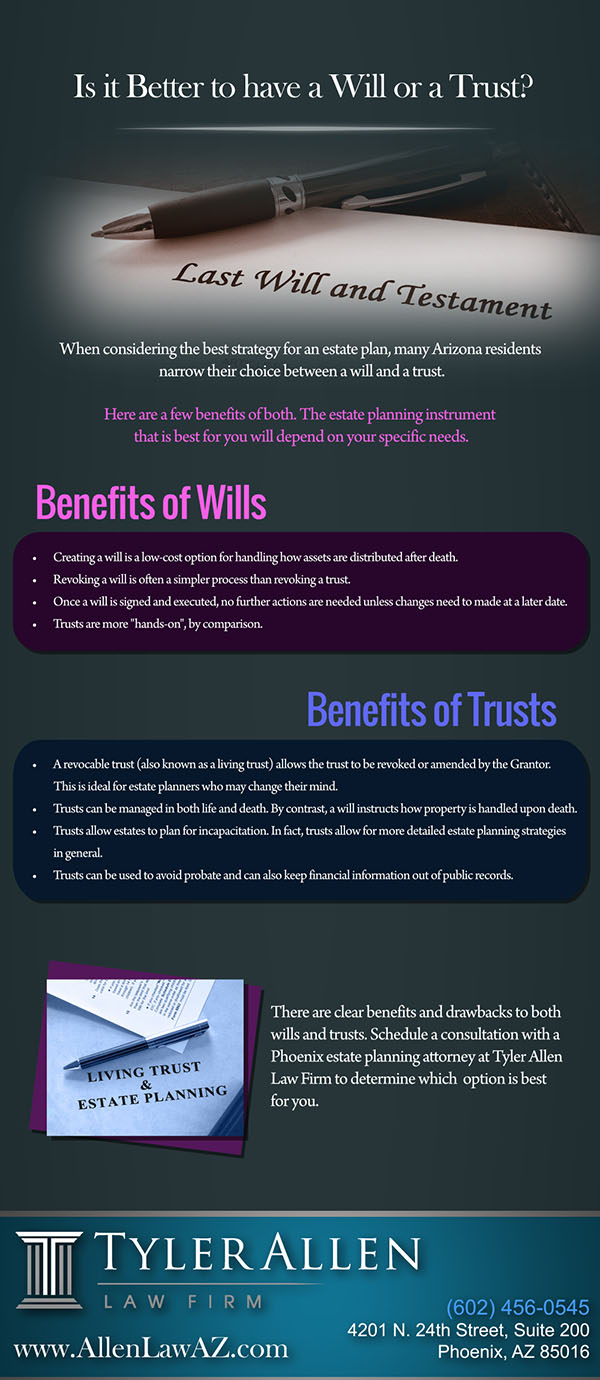

If you do not have a will, the state can make a decision how to divide your properties amongst your heirs, which could not be according to your dreams. An estate preparation lawyer can help arrange all your legal files and disperse your assets as you desire, possibly avoiding probate. Lots of people compose estate planning records and after that forget them.

Everything about Estate Planning Attorney

When a client dies, an estate strategy would certainly dictate the dispersal of assets per the deceased's instructions. Estate Planning Attorney. Without an estate plan, these decisions may be left to the near relative or the state. Duties of estate planners include: Creating a last will and testimony Establishing trust fund accounts Naming an administrator and power of lawyers Identifying all beneficiaries Calling a guardian for small kids Paying all financial debts and decreasing all tax obligations and legal charges Crafting instructions for passing your worths Establishing choices for funeral setups Finalizing guidelines for care if you end up being ill and are unable to choose Getting life insurance policy, handicap income insurance policy, and long-lasting care insurance Get the facts An excellent estate strategy should be upgraded on a regular basis as customers' economic check these guys out scenarios, personal motivations, and federal and state regulations all evolve

Just like any profession, there are qualities and abilities that can assist you accomplish these objectives as you deal with your clients in an estate organizer role. An estate preparation career can be ideal for you if you have the following attributes: Being an estate coordinator indicates believing in the lengthy term.

Some Known Details About Estate Planning Attorney

You must aid your customer expect his/her end of life and what will occur postmortem, while at the same time not house on somber thoughts or emotions. Some clients may become bitter or anxious when considering death and it might be up to you to assist them with it.

In the event of death, you may be anticipated to have countless conversations and transactions with surviving family participants about the estate plan. In order to stand out as an estate planner, you might need to stroll a great line of being a shoulder to lean on and the specific relied on to communicate estate preparation matters in a prompt and professional manner.

Anticipate that it has actually been changed even more considering that after that. Depending on your customer's economic revenue bracket, which might evolve toward end-of-life, you as an estate planner will have to maintain your client's assets in complete lawful compliance with any neighborhood, federal, or international tax obligation legislations.

The Definitive Guide for Estate Planning Attorney

Gaining this accreditation from organizations like the National Institute of Qualified Estate Planners, Inc. can be a solid differentiator. Being a member of these expert teams can confirm your skills, making you extra attractive in the eyes of a possible customer. Along with the emotional reward of assisting customers with end-of-life planning, estate organizers delight in the advantages of a steady revenue.

Estate planning is an intelligent point to do no matter of your existing health and wellness and economic condition. Nonetheless, not numerous individuals understand where to begin the process. The first vital thing is to hire an estate planning lawyer to aid you with it. The adhering to are 5 advantages of dealing with an estate preparation attorney.

An experienced attorney knows what info to consist of in the will, including your recipients and unique considerations. It additionally gives the swiftest and most reliable approach to move your properties to your beneficiaries.